Blockchain In Asset Management: Efficient Portfolio Management

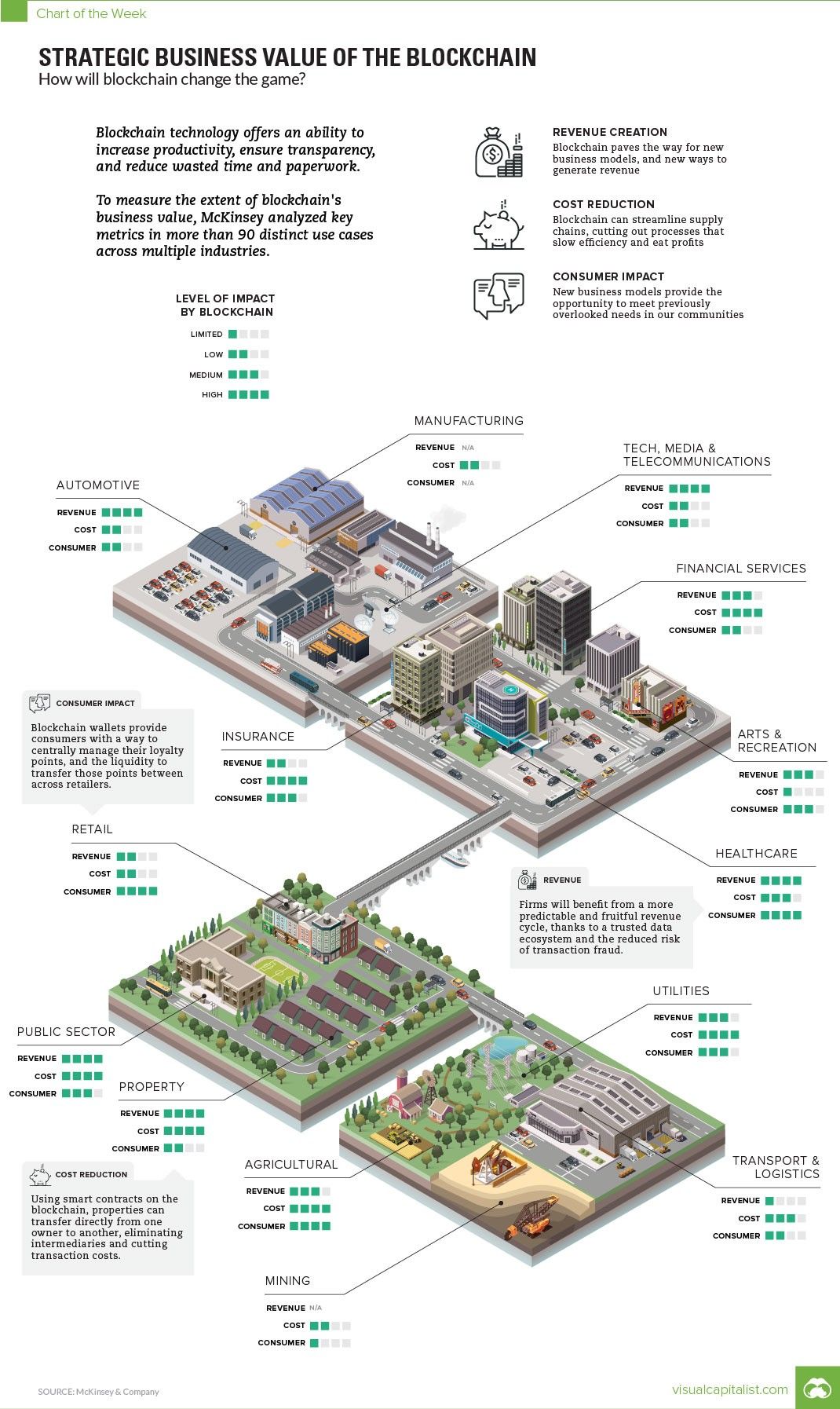

The transformative power of blockchain technology is no longer a futuristic concept, but a tangible reality impacting diverse industries. In the realm of asset management, blockchain is poised to revolutionize traditional practices, ushering in a new era of efficiency, transparency, and accessibility. This article delves into the multifaceted ways in which blockchain is shaping the landscape of portfolio management, highlighting its potential to streamline operations, enhance security, and empower investors.

Introduction

The asset management industry, historically characterized by complex processes and intermediaries, is ripe for disruption. Blockchain, with its inherent attributes of immutability, transparency, and decentralization, presents a compelling solution for addressing longstanding challenges within this sector. By creating a shared, tamper-proof ledger, blockchain can streamline operations, reduce operational costs, and increase efficiency in various aspects of portfolio management.

Beyond operational improvements, blockchain offers enhanced security and transparency, fostering greater trust among stakeholders. Investors can gain real-time insights into portfolio performance and asset holdings, while regulators can monitor activities more effectively. The democratizing power of blockchain also extends to access, enabling individuals to participate in asset management opportunities previously limited to institutional investors.

This article explores the multifaceted ways in which blockchain is impacting asset management, analyzing its potential to revolutionize portfolio management and empower investors. It examines key areas such as tokenization, smart contracts, decentralized finance (DeFi), and regulatory implications.

Tokenization

Tokenization involves representing traditional assets, such as stocks, bonds, or real estate, as digital tokens on a blockchain. This process transforms illiquid assets into fractionalized, easily tradable units, enabling wider participation and increasing liquidity.

- Enhanced Liquidity: Tokenized assets can be traded on decentralized exchanges, eliminating the need for intermediaries and facilitating faster transactions.

- Fractional Ownership: Tokenization allows investors to purchase fractions of assets, opening doors to previously inaccessible investment opportunities.

- Improved Transparency: Tokenized assets are recorded on a public ledger, providing a transparent audit trail of ownership and transactions.

- Reduced Settlement Time: Blockchain transactions are processed faster and with greater efficiency, significantly reducing settlement times compared to traditional methods.

Smart Contracts

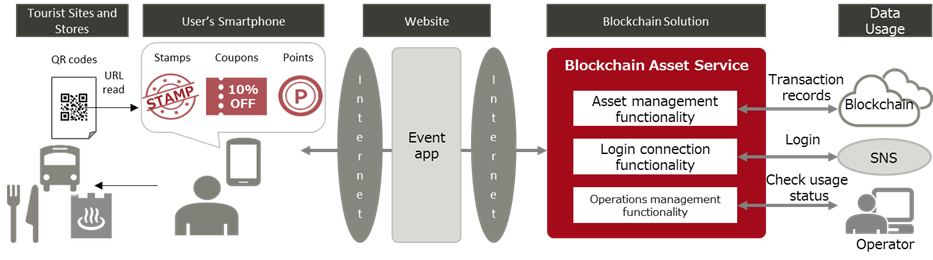

Smart contracts are self-executing agreements written in code and stored on a blockchain. They automate and enforce predetermined conditions, eliminating the need for intermediaries and reducing the risk of human error.

- Automated Portfolio Management: Smart contracts can automate portfolio rebalancing, asset allocation, and other management tasks, freeing up time for portfolio managers to focus on strategic decisions.

- Enhanced Security: By eliminating human intervention, smart contracts reduce the risk of fraud and manipulation.

- Increased Efficiency: Smart contracts automate processes, reducing the need for manual intervention and streamlining operations.

- Reduced Costs: Automation through smart contracts eliminates the need for intermediaries and associated fees, resulting in cost savings.

Decentralized Finance (DeFi)

Decentralized finance (DeFi) leverages blockchain technology to create alternative financial services, bypassing traditional intermediaries. DeFi protocols enable investors to access a range of financial products, such as lending, borrowing, and trading, directly through smart contracts.

- Enhanced Access: DeFi platforms democratize financial services, providing individuals with access to investment opportunities previously restricted to institutional investors.

- Increased Transparency: All transactions on DeFi platforms are recorded on a public ledger, fostering transparency and accountability.

- Lower Fees: By eliminating intermediaries, DeFi protocols often offer lower transaction fees than traditional financial institutions.

- Greater Control: Investors have greater control over their assets in DeFi, as they hold their private keys and manage their investments directly.

Regulatory Implications

As blockchain adoption in asset management gains momentum, regulatory frameworks are evolving to address the unique challenges and opportunities presented by this transformative technology.

- Regulatory Clarity: Regulators are working to develop clear guidelines for the use of blockchain in asset management, ensuring investor protection and market stability.

- Anti-Money Laundering (AML) and Know Your Customer (KYC): Blockchain-based platforms must comply with AML and KYC regulations to prevent financial crime.

- Data Privacy: Regulators are focusing on data privacy concerns associated with blockchain-based asset management, ensuring the protection of sensitive investor information.

- Cybersecurity: Robust cybersecurity measures are essential to protect blockchain platforms from malicious actors and ensure the integrity of transactions.

Conclusion

Blockchain technology is poised to transform the asset management industry, offering a compelling solution to address longstanding challenges and unlock new opportunities. Tokenization, smart contracts, and decentralized finance are reshaping traditional portfolio management practices, enhancing efficiency, security, and accessibility.

The impact of blockchain extends beyond operational improvements, fostering greater transparency and democratizing access to investment opportunities. While regulatory frameworks are still evolving, the potential of blockchain to revolutionize asset management is undeniable. As this technology matures, we can expect further innovation and widespread adoption, empowering investors and shaping the future of the financial landscape.

The benefits of blockchain extend far beyond cost-saving measures. The increased transparency provided by blockchain fosters greater trust among investors and regulators. By creating a public and immutable record of transactions, blockchain eliminates the risk of fraud and manipulation, providing a more secure environment for managing assets.

The potential for blockchain to revolutionize asset management is vast. By streamlining operations, enhancing security, and democratizing access to investment opportunities, blockchain is poised to reshape the financial landscape, empowering investors and driving greater efficiency and transparency across the industry. As regulatory frameworks evolve and adoption accelerates, the transformative power of blockchain in asset management will continue to unfold, ushering in a new era of innovation and opportunity.